Managing your debt effectively is crucial, for maintaining a credit score. Your credit score, which is a representation of your credit history reflects your creditworthiness. Among the types of debt credit card debt is quite common and has the potential to negatively impact your credit score.

Missed or late payments on your credit cards can lower your score while making payments can actually improve it. Additionally the amount of debt you carry often referred to as your credit utilization rate also plays a role, in determining your credit score.

In this article, we’ll discuss how credit card debt affects your credit score and offer advice on handling personal debt properly.

What is a Credit Score?

A credit score, which consists of three digits, evaluates your creditworthiness. The range of FICO scores is 300 to 850. The likelihood that you will be accepted for loans and receive better rates increases with your credit score.

Learn more: Understanding Credit Scores: How to Improve and Maintain a Good Credit Score- July 2023

Your credit history, which includes details such as the number of accounts, total amounts owed, payment history, and other elements, is what determines your credit score. Lenders assess your credit worthiness, or the chance that you will repay loans on time, using your credit ratings.

How Is A Credit Score Determined?

When calculating your credit score credit scoring models consider factors. These elements are essential in figuring out the danger of giving you money and evaluating your creditworthiness. Your history of on-time bill payment is first and foremost. This covers your history of timely bill payment as well as any prior instances of late or defaulted payments.

Another crucial component is your current outstanding debt, which represents your ongoing financial commitments. The quantity and diversity of loan accounts in your name and the age of these accounts are also assessed. A lengthier credit history often bears more weight since it offers a more comprehensive picture of your monetary habits. Additionally taken into account is how much of your allotted credit you use.

Finally, credit scoring algorithms consider recent credit applications because having several credit inquiries quickly may indicate that you need more money, which might lower your score. To keep a good credit score, it’s critical to comprehend these elements and handle them appropriately.

How Credit History Affects Financial Opportunities

Your credit history is a critical thread in the intricate web of today’s financial systems that may either create a tapestry of chances for you or trap you in one. It is impossible to exaggerate the importance of your credit history since it has a significant impact on the kind of financial options that are open to you.

Your credit history is a versatile instrument that may impact your financial future, helping you obtain loans and credit cards, rent an apartment, and even secure your ideal job.

Read More: What is Sustainable Investing How to Align Your Profits with Environmental Goals- July 2023

We will examine the many ways that your credit history influences your financial chances in this thorough investigation, providing insights into the workings, ramifications, and approaches for managing this crucial area of your financial life.

The Role of Credit Reports

Understanding Credit Reports

A credit report essentially serves as a person’s financial report card and offers a thorough credit history overview. It is created by credit bureaus, often known as credit reporting agencies. Experian, Equifax, and TransUnion are a few examples. These businesses collect and compile data from several sources, including creditors, lenders, and public records, in order to create a comprehensive picture of a person’s credit behavior.

Components of a Credit Report

A typical credit report comprises several key components:

Personal Information: Your name, present and past residences, birthdate, and Social Security number are all listed in this area. To prevent confusion or concerns with identity theft, it is important to make sure that this information is true.

Credit Accounts: The “heart” of your credit report is the section that lists all of your credit accounts, including credit cards, loans, mortgages, and retail accounts. Each account contains the name of the lender, the account number, the credit limit or loan amount, the current balance, and the payment history.

Payment History: A critical component of your credit report is your payment history. It keeps track of when your payments were made on time, when they were late, and when you were behind on any bills. Your credit score is impacted favorably by timely payments, but negatively by defaults or late payments.

Read more about it: How Your Credit Score Impacts Your Financial Future

Credit Inquiries: This section includes any inquiries creditors or lenders have made regarding your credit history. There are two types of searches: hard searches, which you start when you apply for credit, and soft searches, which are typically related to background checks or pre-approved offers. Your credit score will momentarily drop if you make a lot of difficult inquiries rapidly.

How Credit History Affects Financial Opportunities

Access to Credit

Your ability to access credit is one of your credit history’s most direct and immediate effects. Lenders look at your credit history when you apply for a loan or credit card to determine the risk involved in lending you money.

Your chances of getting approved are increased by having a good credit history, which is demonstrated by on-time payments and prudent credit management. This can lead to more favourable conditions, such as reduced interest rates.

Read more: What’s In Your Credit Report

A bad credit history, damaged by missed payments, defaults, or bankruptcy, on the other hand, might make it difficult to obtain credit. Even if you are accepted, the cost of borrowing might rise dramatically due to increasing interest rates and unfavorable terms.

Loan Terms and Interest Rates

The interest rates and terms that lenders will provide you will directly be influenced by your credit history. Credit scores, which are based on your credit history, are used by lenders to assess the risk you offer as a borrower. Higher credit scores are thought to indicate lower risk borrowers, and as a result, they frequently qualify for loans with lower interest rates and better conditions.

A borrower with a stellar credit history, for instance, may be qualified for a mortgage with a low fixed interest rate, which would result in significant savings over the course of the loan. On the other hand, a person with a bad credit history could only be approved for a mortgage with a higher interest rate, resulting in a noticeably greater total debt.

For example, take into account the following two applicants for a car loan:

Borrower A has a flawless credit history with no late payments or defaults, an exceptional credit score (over 800), and a high credit limit.

The credit history of Borrower B contains a few late payments as well as a previous collection account. His credit score is fair (about 650).

When both borrowers apply for the same auto loan, Borrower A is probably going to be approved for the loan at a rate that is much lower than Borrower B’s. Because of this, Borrower A will pay less throughout the course of the loan, increasing the affordability of the financing.

Employment Opportunities

Your work possibilities are significantly impacted by your credit history, which has effects that go well beyond simple financial transactions. Your credit history may be taken into account by companies when making recruiting decisions in several fields and businesses. Understanding this relationship is essential because it emphasizes how crucial it is to keep a good credit history in order to perhaps improve your employment possibilities.

A good credit history is frequently regarded by employers who do background checks as a sign of fiscal discipline. They could think that those who have good financial management are more inclined to act responsibly at work. On the other hand, a damaged credit history could make others wonder about your honesty with money, which might affect your employability.

Read More: Understanding Crypto Wallets: How to Choose the Right Type to Manage your Digital Assets- July 2023

Financial management is a requirement for several work tasks, including those in accounting, finance, or access to business finances. In these situations, companies can be extra cautious in checking the credit histories of potential hires because they wish to reduce the possibility of financial misconduct within their firms. Credit checks are frequently a part of the clearance process for jobs requiring security clearances, especially those in government or defense-related positions.

An unfavorable credit history might be a warning sign since it may indicate vulnerability to financial strain, which may jeopardize security. Credit checks may be required by some businesses as part of their employment procedures or for certain positions. Depending on the sector, the location, or the judgment of each employer, these policies may change.

Some jurisdictions have regulations restricting their usage, and not all companies utilize credit checks when employing new employees. Examine your report for accuracy, improve it over time by making on-time payments and paying down debt, and be aware of local laws so that you may take legal action if your rights are infringed to lessen the influence that your credit history has on your ability to get a job.

Housing Opportunities

Landlords frequently ask for a credit check when a tenant applies to rent an apartment. A good credit history might increase your chances of getting approved, while a bad one can get you turned down or force you to put down a bigger security deposit.

A bad credit history may be interpreted by landlords as a sign of possible reliability problems with rent payments. Your credit history is crucial when applying for a mortgage if you want to buy a house. Mortgage lenders evaluate your creditworthiness using your credit score and credit record.

A solid credit history can lead to the acceptance of a mortgage with better terms, such as reduced interest rates. A less-than-ideal credit history, on the other hand, can result in higher interest rates or mortgage denial. Credit checks are typical, even in rent-to-own housing agreements.

Read more: Understanding the Ripple effect: How Interest Rates Impact Your Finances- August 2023

The parameters of the agreement could change depending on your credit history. A good credit past can make it simpler to get a rent-to-own agreement, while a bad credit history may result in less advantageous conditions. Some jurisdictions have regulations restricting their usage, and not all companies utilize credit checks when employing new employees.

Examine your report for accuracy, improve it over time by making on-time payments and paying down debt, and be aware of local laws so that you may take legal action if your rights are infringed to lessen the influence that your credit history has on your ability to get a job.

The Impact of Credit Card Debt on Your Credit Score

Your credit score, a three-digit figure that acts as a gauge of your creditworthiness, can be significantly impacted by credit card debt. It’s essential to comprehend how credit card debt impacts your credit score if you want to keep your financial profile in good shape and take advantage of advantageous financial possibilities.

How Credit Card Debt Affects Your Credit Score

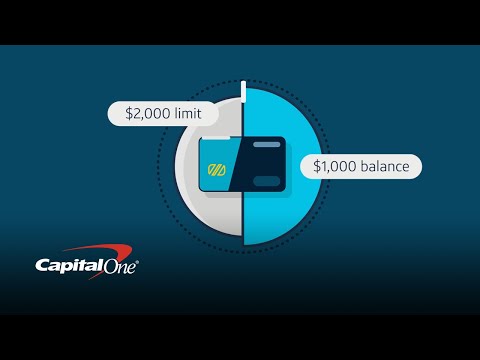

Credit utilsation: The use of credit is one of the most important ways credit card debt impacts your credit score. Your credit card balances to credit card limits are expressed as a percentage here. Your credit score might be harmed by having high credit card balances in comparison to your credit limits. It’s typically advised to keep your credit use below 30% in order to retain a decent score. If your credit limit is $10,000, for instance, you should try to maintain your balance below $3,000 at all times.

Payment History: Your credit score is heavily influenced by your credit card payment history. Negative entries on your credit report from missing payments, late payments, or defaults on credit card debt can cause a large drop in your credit score.

Read more: Prioritizing Debt Repayment: Strategies to Pay Off your Debt and Stay Afloat- July 2023

Credit Mix: Your credit score takes into consideration all of your credit accounts, including your credit cards. Your credit score can be positively impacted by having a variety of credit kinds, such as credit cards, installment loans (such as mortgages or auto loans), and retail accounts. You can show that you can manage various forms of credit by managing your credit card debt responsibly.

Examples of Credit Score Scenarios

Low Credit Card Debt Scenario: Assume you have three credit cards with a combined credit limit of $20,000 and a total debt of $2,000 on each of them. Your credit card usage is responsible, as seen by the low 10% credit utilization percentage. Your credit score will probably benefit from your low credit card debt.

High Credit Card Debt Scenario: Assume your credit card balances have climbed to $15,000 and your credit limits are still $20,000 in Scenario 2. Your credit usage ratio has increased to 75%, indicating that you have a lot of credit card debt compared to the credit you have available. Your credit score might be severely lowered as a result, which would make it difficult to get new credit or favorable loan conditions.

Scenario 3 – On-Time Payments: No matter how much credit card debt you have, making on-time payments on a regular basis will help you keep or raise your credit score. To prevent late payment entries on your credit report, it’s imperative to pay at least the minimum amount due on time, even if you carry a balance.

Moreover, the FICO score also impacts your credit score.

Understanding the FICO Score

The FICO Score is a widely used and significant credit scoring algorithm that has a wide range of effects on our financial lives. Your FICO Score greatly impacts the decision whether you’re applying for a credit card, a mortgage, a job, or even renting an apartment. This in-depth exploration of the FICO Score will cover its history, its variables, how it affects financial choices, and how to maintain and raise your score.

What is a FICO Score?

Fair Isaac Corporation, the business that created the FICO Score, is known by the initials FICO. An individual’s creditworthiness is assessed using a credit scoring model based on their credit history. Lenders, creditors, landlords, employers, and others use the FICO Score to determine the risk involved in making loans, extending credit, renting out space, or hiring people.

Origins of the FICO Score

Earl J. Isaac, a mathematician, and engineer William R. Fair developed the FICO Score in the late 1950s. Their goal was to develop a credit risk assessment technique that was more consistent and objective. Before the FICO Score, loan choices frequently depended on arbitrary assessments and interpersonal connections. Through the introduction of a standardized, data-driven method for assessing credit risk, the FICO Score transformed the lending sector.

How is the FICO Score Calculated?

The data in your credit report, which is kept up to date by credit agencies (Experian, Equifax, and TransUnion), is used to determine your FICO Score. Your FICO Score is determined by a secret algorithm, however the following broad elements and their weightings are well-known:

Payment History (35%): Your payment history accounts for the majority of your FICO Score. This includes whether you have made on-time credit card payments, any late payments, had any accounts sent to collections, or have filed for bankruptcy.

Amounts Owed (30%): This component takes into consideration your overall debt, credit usage (the proportion of your credit limits that you are really utilizing), and the balances on various account types, including credit cards and installment loans.

The duration of your credit history (15%) is another factor that your FICO Score takes into account. Longer credit histories often provide an advantage.

Read more: Introduction to Cryptocurrency: The PROs and CONs Cryptocurrency Investing- June 2023

Credit Mix (10%): This component assesses the range of credit accounts, including credit cards, mortgages, auto loans, and retail accounts, that you have. Your score may benefit from having a variety of credit types.

New Credit (10%): Opening a lot of new credit accounts quickly might lower your FICO Score. This factor takes your most recent account openings and credit queries into consideration.

Impact of FICO Score on Financial Decisions

Your life’s financial choices are significantly influenced by your FICO Score:

Credit Applications: Lenders evaluate your FICO Score to determine your creditworthiness when you apply for a credit card, personal loan, auto loan, or mortgage. A higher score may result in quicker approval and better conditions, such reduced interest rates.

Interest Rates: The interest rate you’ll pay on loans and credit cards is primarily based on your FICO Score. Higher-scoring borrowers qualify for reduced interest rates, which can save them a lot of money over the course of a loan.

Opportunities for Housing: When reviewing rental applications, landlords and property managers frequently examine your FICO Score. A high score can increase your chances of being accepted, whereas a low score can result in rejection.

Employment: During the employment process, certain companies, especially those in the financial, governmental, or roles with financial responsibility, may check your FICO Score. A low score could cause employers to wonder whether you’re financially responsible, however it won’t affect all employment possibilities.

Read More: How Are FICO Scores Calculated?

Insurance Premiums: To set your premium rates for car, house, and other forms of insurance, insurance firms may utilize credit-based insurance ratings (connected to your FICO Score). Lower premiums may be the outcome of higher scores.

Managing Your FICO Score

For the purpose of obtaining advantageous financial prospects, maintaining a strong FICO Score is crucial. Following are some tips for managing your score well:

Make On-Time Payments: The most important component of your FICO Score is your payment history, so make sure you always pay your bills in a timely manner.

Reduce Credit Card Balances: Strive to pay off all of your credit card debt each month by keeping your balances low. Your credit score might be impacted negatively by high credit card balances compared to your credit limit.

Avoid Opening Too Many New Accounts: Applying for several credit cards or loans at once will result in several hard inquiries, which could affect your credit score.

Review Your Credit Report: Consistently look for mistakes in your credit reports.

Diversify Your Credit Mix: Opening unauthorized credit accounts is not recommended, but having a variety of credit (such as credit cards and installment loans) might help your credit score.

Improving Your FICO Score

If you wish to improve your FICO Score or have a poor score, it is feasible with time and prudent money management. Observe the following actions:

Address Negative entries: Work on resolving any negative entries, including missed payments or accounts that are in collections, that appear on your credit report. Set up payment arrangements or engage in negotiations with creditors to resolve debts.

Pay Off Debt: Lower your credit card and loan amounts to increase your credit usage ratio.

Create a favorable Payment History: Moving ahead, make payments on time consistently to create a favorable payment history.

Avoid Credit Pitfalls: Steer clear of actions that can harm your credit, such as defaulting on loans or missing payments.

Credit Utilization and the Benefit From It

The amount of credit you are utilizing in relation to the amount of credit you have available is known as credit usage. It is one of the most significant elements taken into account by credit bureaus when determining your credit score. By dividing the entire amount of credit you are currently utilizing by the total amount of credit you have available, you may get your credit usage rate.

For example, if you have a credit card with a $5,000 limit and you have a balance of $1,500, your credit utilization rate is 30%.

A credit usage percentage of under 30% is optimal. However, go for a credit score below 10% to receive the best results. Maintaining a low credit usage ratio demonstrates to lenders that you are responsible with credit and have sound money management skills. On the other side, a high credit utilization ratio may be a sign that you are overextended and at danger of making untimely payments on your bills.

Maintaining low credit card balances is crucial for maintaining a high credit score. Aim to keep your overall credit usage percentage under 30% when you do carry a load. So, if you have several credit cards, aim to keep the balance on each one below 30% of the total available credit. Your total available credit, for instance, would be $15,000 if you had three credit cards with $5,000 credit limits each. You should strive to keep the combined amount on all three cards under $4,500 in order to maintain a credit usage percentage under 30%.

Here are some strategies to improve your credit utilization ratio:

- Each month, pay off or at least reduce your debt. This will support a low credit use ratio and gradually raise your credit score.

- Be strategic about when you pay. Try to make your payments prior to the statement closure date if you are unable to pay off your amount in full each month. This will guarantee that the credit bureaus will record your debt as being low.

- Request a larger credit limit. If you see that you frequently spend more than 30% of your overall credit limits, you might want to call your card issuer and request an increase in credit limits. It is simpler to maintain a low credit usage ratio when there is more credit overall accessible.

- Use many credit cards. Spreading out your spending over numerous credit cards will help you maintain a low credit usage percentage on each card.

- Maintain open credit accounts. Your available credit may be decreased and your credit usage may rise due to closing credit accounts. Even if you aren’t using your credit cards, keep them open to keep your credit usage ratio low.

Learn more: What is Credit Utilization Rate?

Managing Personal Debt

Managing personal debt can be a challenging task, but it is essential to maintain financial stability. Here are three steps to help manage personal debt:

Assessing Your Personal Debt

To properly manage personal debt, you must first assess your financial situation. Calculating your entire debt, which includes credit card debt, loans, and mortgages, is necessary. It’s also essential to understand your monthly income and expenses in order to comprehend your cash flow. This information may be used to create a budget and determine how much cash you can set aside for debt repayment.

Creating a Personal Debt Profile

In order to manage your debt effectively, it is essential to organize your debts according to important parameters like interest rate, balance, and minimum payment. This is done by creating a personal debt profile. You may then strategically prioritize them for repayment after you have a clear grasp of which loans are costing you the most in interest fees.

For instance, focusing on high-interest bills first, like as credit card balances, might help you avoid accruing further debt from interest, thus saving you money and hastening the process of getting out of debt. You may create a systematic approach and follow your progress more easily by categorizing by balance and minimum payment. This will help you prevent late penalties and credit score harm.

Overall, developing a debt profile gives you the direction and plan need to approach your obligations systematically and reclaim financial control.

Identifying Problematic Debt

Effective personal debt management starts with recognizing problematic debt. It comprises identifying and setting priorities for debts that seriously jeopardize your financial stability. Debt that is problematic can take many different forms, such as debt that is past due, in collections, or that has high interest rates. Since these debts have the ability to make your financial difficulties worse, paying them off as soon as possible is imperative.

For instance, late penalties and credit score harm from past due obligations might make it more difficult to get future credit or loans. Legal action and further financial hardship may result from unpaid debt in collections. Credit card debt, for example, has a high rate of interest that can quickly add up and increase your entire debt load.

When dealing with significant debt, it is wise to seek expert help. Services for credit counseling can provide expert advice on managing your debts, coming up with repayment schedules, and negotiating with creditors to perhaps decrease interest rates or payments.

Debt management plans offer organized frameworks for debt consolidation and repayment, frequently with the aim of lowering the overall amount owing. These tools can greatly assist you as you attempt to reclaim control over your money, stop the decline of your credit score, and move toward a more secure financial future.

In summary, proactive debt management and expert assistance can be crucial steps on your path to better financial stability and debt relief.

Recap of Key Points

We started our exploration of personal finance by learning how much credit card debt affects your credit score. We discovered how poor creditworthiness may be harmed by excessive credit card balances, late payments, and defaults, thus limiting your access to credit and influencing loan conditions. We investigated broader aspects of credit scores, such as payment history, credit use, length of credit history, credit mix, and new credit inquiries, in addition to credit card debt. It’s essential to comprehend these elements if you want to keep a solid credit profile.

For long-term financial stability, it is essential to lay a solid financial basis. This entails many crucial actions: Create an emergency fund first, often with three to six months’ worth of living costs, to act as a safety net for money in case of unforeseen circumstances. Next, develop a practice of saving money and think about funding retirement accounts like a 401(k) or IRA while looking into investing options to gradually increase your wealth.

Spreading your investments across several asset classes will help you manage investment risk since diversification is important. Establish specific financial objectives to help you stay motivated and on track with your finances, and keep learning about personal finance so you can make well-informed choices.

Consider estate planning as well to make sure your assets are handled and dispersed in accordance with your preferences. Regularly evaluate and modify your financial plan to take into account your changing needs. When dealing with complex financial issues, consulting with financial consultants, accountants, or estate planning lawyers may be very helpful.

Thank you for your sharing. I am worried that I lack creative ideas. It is your article that makes me full of hope. Thank you. But, I have a question, can you help me?