One of the most difficult things in managing finances is saving money. At a time when inflation is constantly increasing, achieving personal financial goals can give you a tough time. But, once you start the journey of money budgeting, you may not look back. Here we will discuss a few financial independence tips to achieve your goals on time.

What are financial goals?

Financial goals are money-saving targets that one sets for both short-term and long-term purposes. Setting a budgetary goal is another way to gain financial freedom. These goals may differ; what is important to one may not be important to the other person. Planning financial goals requires that a person understand finances and money budgeting.

Read More: Understanding Investment Basics: Five startup sectors that you can invest in for financial success

Achieving financial goals includes thinking about earnings, investments, expenditures, and savings. Analysis of all these components will help in fulfilling your financial goals. A good financial goal has a clear path to achieving that goal.

Money-Saving Strategies

Implementing effective money-saving strategies is important to build a strong financial foundation and prepare you well for unexpected expenditures. Here are a few strategies that you can use in your daily money budgeting

Keep a record of your finances

A track record of your expenses can help you determine how much you spend in a month. Start with recording every penny you spend and include the tips you give away.

You can keep a record in a notebook or make a sheet on your computer. Once you have compiled a few months’ records, you can separate them into categories. A few basic expenditure categories include bills, groceries, mortgages, and personal expenses.

You can even download good budgeting apps to help you plan your finances for the month. These apps are also helpful in keeping a log of all your expenses and comparing these expenses at the end of the year. Some apps have built-in notification systems that remind you to achieve your set financial goals.

Create a money budgeting record

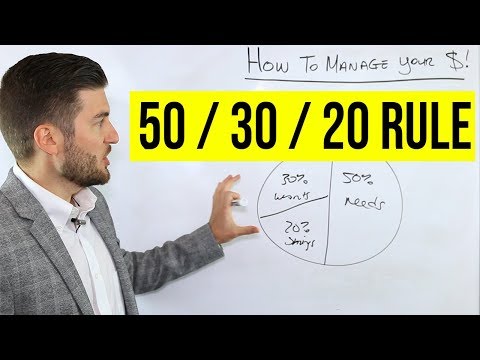

The track record will help you analyze where you are spending the most. It will also give you an idea of the average amount you spend on each category. If someone asks how much should you save on your paycheck? Just tell them to follow the 50-30-20 rule. The general thumb of rule is that you keep aside 50% of your money budgeting for necessities, 30% for personal spending, and 20% for savings.

Read More: How to Save Money: 23 Simple Tips

This money-saving must be an essential part of your budget as it will help you in paying off expenditures that come up unexpectedly. You can slowly increase the money budgeting as you cut off on your useless spending.

Save more than you spend

How much money you should save each month depends on your monthly expenditure. Saving more than you spend is necessary when you cannot find ways to money budgeting. It is one of those times when you have to think back and look at your expenses.

Trimming expenses may be difficult for those who spend lavishly, but it is the top financial independence tip to follow. Look into where you are spending the most; it may be frequent dine-outs, takeaways, or even frequent shopping. Cut back on those expenses to start your baby steps toward money saving.

Creativity to make more money

Use your thinking capacity and work on how you can earn more money. Have a certain skill? Why not try to get a part-time job or freelance? You can even sell the things in the house that are no longer needed. All of this will eventually add up to good budgeting habits.

Read More: Saving and investing for your future

A part-time job may add more work hours to your tough routine, but it is necessary to meet your financial goals. You may have random collectibles, jewelry, or even clothes you no longer need. Consider thrifting or selling them on platforms connecting you to buyers online.

Digitized and Automatic saving

Are you wondering how much money you should save each month? A digitalized and automatic means of money budgeting may be your answer. These money-saving means allow your bank app to transfer a certain amount of your salary to another money-saving account. It ensures you set a predefined amount of money to transfer whenever you want.

One of the advantages of this money saving is that you don’t have to remember to put away your savings. It is also automated and will be transferred to your money-saving account before you begin spending.

You can also look into reward programs or spare change programs. These programs allow you to round up your money savings to the nearest dollar, which makes a big difference in your total amount.

Understand options to invest and stick to them

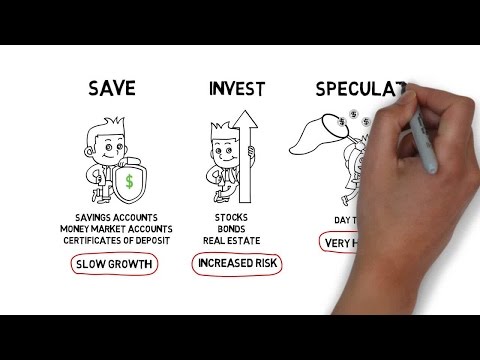

There are plenty of options to invest your money into. People who are aware of their investment options can benefit from seeing their money grow. Some investment options are volatile, yet they have higher risk factors for loss. Some, on the other hand, have slow growth but fewer chances of risk factors.

For starters, you can look into safer options such as mutual funds or money-saving bank accounts. As you gain more knowledge on investment, you can experiment more with your investment strategies.

Read More: Types of Investments

The key to a successful investment plan is that you stick to it for the long run. It is not something to be stopped and then restarted all over again. You can review the investments you have made annually or biannually and then decide how to proceed.

Ask for Professional Advice

Never be afraid to seek professional help. Not everyone is good with finances and money budgeting, and if you think you are not on the right track then get help from a financial advisor.

You can either select a traditional advisor who will charge a certain fee for his guidance or a robo advisor who charges much less and helps you with your financial portfolio. Professionals are the best people who can teach you money-saving strategies and how to utilize them best.

Set Money Saving Goals

Setting goals can not only help you with budgeting, but it can also help you in making wise financial decisions. First, decide what you want to save for to set your money-saving goal. These goals can be short-term, for one to three years, and long-term, for around four years. Decide the money budgeting based on the goals that you set. A few examples of building a savings plan include:

Short-term goals – Emergency funds such as car maintenance, paying off education fees, or any unforeseen event.

Long-term goals – to buy a house or a car, save for your child’s education, or retirement plans

Select the right tools for saving

There are a number of money-budgeting apps and spreadsheets that are free to download. Money-saving apps help build a savings plan and an expense plan as well. These tools can also help you assess your annual expenditures and savings.

Tips to Save Money

One of the easy ways to save money is to set small achievable targets that require money budgeting for a few months. These goals can be something fun you want to do, such as buying a laptop or a birthday gift. Reaching these small targets can give you a motivational boost to save more. Eventually, you will also develop the habit of saving money to achieve long-term financial goals.

Read More: Options vs. Stocks: Which Is Right for You?

While all of the above points can help you manage personal finances and achieve your financial goals, here are a few extra tips that can help you out

Look for free activities

When going out with friends or family, look for free activities or attractions. You can even look for restaurants that have a certain discount on purchases.

Avoid extra memberships

Review your list of subscriptions and memberships, since most of these continue to deduct payments without your knowledge. Try to cancel subscriptions that are not needed, especially the ones that renew themselves automatically.

Prepare at home

Certain expenses can be avoided simply by preparing them at home. Coffee, snacks, and even food costs are some of such expenditures. If you compare the cost of preparing a meal at home to buying it, you will find the former option much cheaper. Occasionally dine-outs can be an exceptional case.

Think before you spend

When you want to purchase something non-essential, wait for a few days. If, after a few days, you still think that you need it, then go ahead and make the purchase. Chances are that you will realize it is something you no longer need.

25x Rule of Retirement Saving Tips

One way to create a personalized goal for your retirement is to use the 25x rule of money budgeting. But first, you need an estimate of your annual expenses when you retire and multiply the amount you get by 25. For example, if the annual expense when you retire will be $10,000 then according to the 25x rule, you will need $250,000 after you retire.

Building a money-saving plan for retirement may be difficult for a teenager. But, the earlier someone understands the concept of these retirement-saving tips, the better it is for them when they reach old age.