Have you ever applied for a loan from the bank but got rejected? Do you have a colleague whose loan got accepted despite having less salary? Here is where the credit score comes in. It is a type of financial score that helps to reflect how a person managed their debt in the past. This debt management history shows up in the form of a score calculated by a credit bureau.

Creditors often utilize this three-digit score to determine your worth of getting credit. It includes setting the terms for mortgages and other loans. Landlords also use this score when they apply to rent out a place. Therefore, maintaining a good credit score is important since it affects your financial future.

What is a Debt?

In financial terms, debt is any amount a person borrows from someone else. It is the amount the person has to pay back after a certain number of days. Before taking on debt, it is important to analyze and assess all terms and conditions. Most borrowers have to pay an amount far greater than what they asked for because of the percentage of interest.

What is a Credit Score?

A numerical representation of any person’s creditworthiness is called a credit score. This score indicates how likely a person can repay their debts. A typical range of scores lies between 300 to 580, with higher scores showing better creditworthiness. It is based on credit reports and helps lenders to assess the risk associated with giving a person their money.

How to Calculate Credit Score?

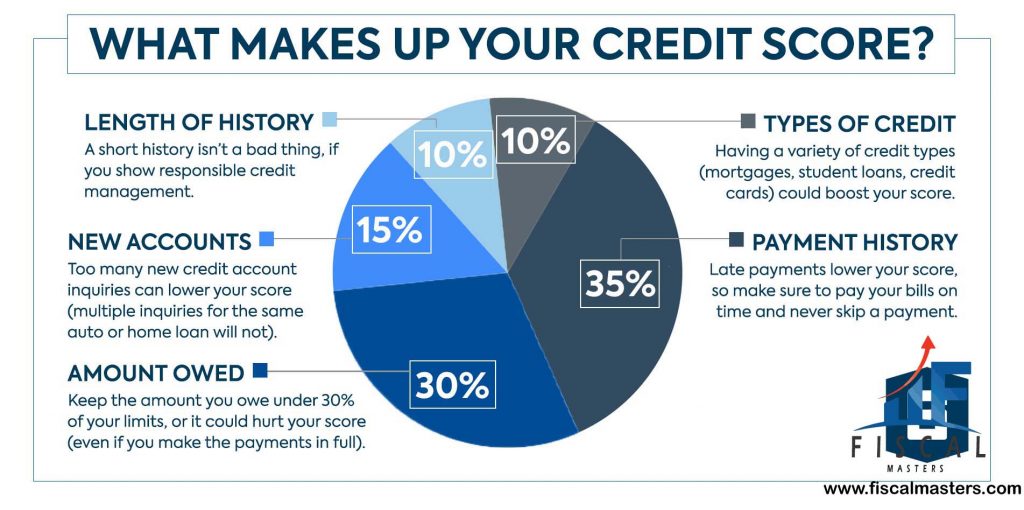

A credit score is calculated with the help of several factors, such as payment history, credit utilization and Length of credit history. Additional factors that affect credit scores include the type of credit card used and the latest credit inquiries. Lenders commonly utilize credit scoring models such as FICO and Vantage score.

Among all these factors, payment history and credit utilization affect this score the most. On the other hand, when a person has late payments and a high balance on their credit card, it can reduce their score to a lower percentage. A person must have prompt payments and positive credit behaviours to improve this score.

Importance of Credit Score Range

Higher credit scores above 700 are favourable and help improve loan acceptance and low-interest rates. If it is less than 600, this may limit loan approval options from banks, leading to higher interest rates and rejection of loans. It is important to understand the ranges of this financial score so that people can be aware of their financial health. Being financially aware also helps people to improve and make better decisions.

Factors that Affect Credit Scores

Before you understand how to increase your credit score, knowing the factors that affect it is important. The exact criteria for every credit scoring model may differ. However, here are a few common factors that may affect your debt management skills:

Payment History and On-time Payments

Payment history is an important factor that affects a person’s credit score. A person who makes timely payments shows responsible financial behaviours. On the other hand, if someone makes late payments, then it can negatively affect their credit history.

Credit Utilization Ratio and Managing Credit Limits

The credit utilization ratio is the percentage of a person’s available credit limit that they utilize. Keeping a low credit card balance compared to the credit limit is necessary for a good score. If someone has a high ratio, it means they are under financial stress. Therefore, it is advisable to keep this utilization ratio below 30%.

Read More: Introduction to Cryptocurrency: The PROs and CONs Cryptocurrency Investing- June 2023

Length of Credit History and Building a Positive Payment History

A longer credit history has more data and helps lenders to assess a person’s creditworthiness. Building a good track record is important by consistently paying on time to improve one’s score.

Types of Credit Accounts

A diverse mix of credit accounts, such as mortgages, credit cards, and loans, can positively affect credit scores. It shows that a person can responsibly handle financial stressors. However, one must open only one account to establish creditworthiness.

How to Improve Your Credit Score

There must be more than a good score to get loans approved or borrow money. It can affect everything, even as small as renting an apartment or getting a cell phone package plan. Establishing a good score is important in today’s world. Here are a few strategies that any person can implement to have a great credit score:

Review of Credit Report and Identification of Errors

Regularly reviewing the credit report helps identify errors or discrepancies that may negatively affect a person’s score. If there are any inaccuracies, the person must promptly report them and file a dispute with the credit bureaus. Providing supporting documents helps to strengthen the case. Correction of these errors can help improve the score so that they reflect the actual financial standing of a person.

Read More: How to Improve Your Credit Score

Paying Bills on Time and Avoiding Late Payments

Consistent on-time bill payments are an effective way of managing credit card debt. Similarly, if someone pays their credit card bills after the due date, it affects their scores negatively. Therefore, it is essential to pay off all these bills timely.

Building a Positive Credit History and Avoiding New Debt

Being responsible and building a good credit score shows positive behavior. It includes timely payments and getting rid of excessive debt. Refraining from taking on new debts also shows financially responsible behaviour. Opening new credit accounts can lower these scores, but this effect is temporary.

People must focus on building a good history on their existing accounts instead of opening new ones. Managing these existing accounts responsibly helps in managing credit card debt in the long run.

Keep Old Account Open and Deal with Delinquencies

Keeping old accounts open means that you are not closing your old credit card accounts, especially from Experian, Equifax or TransUnion. Closing credit cards from these three major companies will cause your credit score to go negative. Once you close your old credit account, the credit bureau will remove your credit file. Losing all the credit history means a reduction of your overall average credit age.

Additional Credit Score Improvement Tips and Practices

How long can it take to Rebuild Credit Score?

Building a good score is important; there is no specific time to rebuild one. It depends on all the steps and measures a person takes to rebuild it. If that person is all in and takes steps cautiously, his credit score will improve quickly. Alternatively, if there are no measures taken and the person does not take it seriously, then there are even higher chances for the score to decrease even more.

Understanding that credit score does not fall after missing one payment is important. It falls after a person continuously pays late on several credit accounts. The effect on the score can be much higher if this causes foreclosure or repossession.

Read More: Managing Personal Finances: Ten Tips for Money-Saving to Achieve your Financial Goals- June 2023

Some companies specifically work to repair credit scores. But all of these services come with a price. Similarly, some companies help with debt settlement. No matter how intriguing it may sound, these companies encourage you to pay less than you owe to settle the debt. However, it affects your credit score negatively.

Summary

In this article, we discussed the various factors that can affect the credit scores, such as payment history, credit utilization and diversity of credit. Anyone can implement various credit score management strategies to improve their credit score. Additionally, avoiding excessive credit inquiries and seeking professional assistance whenever possible is important. Improving and building a good credit score must be accessible to everyone.

By implementing these credit score management strategies outlined in the article, individuals can manage their financial health and access better credit opportunities. It is always possible to start, so you better start taking action today to create a future with a strong credit profile.

Your article helped me a lot, is there any more related content? Thanks!